What is a Form 7004?

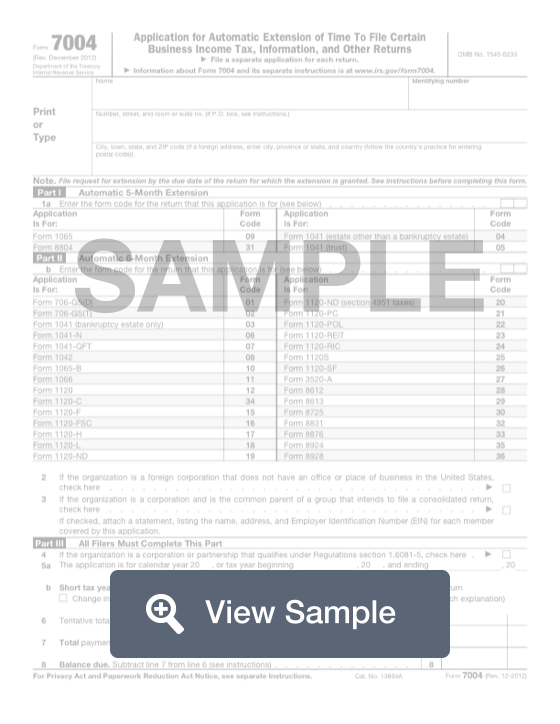

A Form 7004 is also known as an Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns. The form is related to tax filing in the United States and will be received and recorded by the Internal Revenue Service. Filing this form will allow a business to get an extension on the date they have to file their taxes by. While the date to file the forms will be pushed back, the business must still pay their owed taxes on time.

Businesses can use this form to apply for a 5 month or 6 month extension. They must meet certain qualifications in order to get an extension from the IRS. The extensions can also only be requested for certain tax forms. You will need to identify these forms on the application. The business will also need to include a rough estimate of their taxes owed for the year. This will ensure that the payments made will be as accurate as possible.

How to complete a Form 7004 (Step by Step)

To complete Form 7004, you need to provide the following information:

- Personal Information

- Name

- Identifying number

- Address

- Part I - Automatic Extension for Certain Business Income Tax, Information, and Other Returns

- Code for return that application is for:

- 01 - Form 706-GS(D)

- 02 - Form 706-GS(T)

- 03 - Form 1041 (bankruptcy estate only)

- 04 - Form 1041 (estate other than a bankruptcy estate)

- 05 - Form 1041 (trust)

- 06 - Form 1041-N

- 07 - Form 1041-QFT

- 08 - Form 1042

- 09 - Form 1065

- 10 - Form 1065-B

- 11- Form 1066

- 12 - Form 1120

- 34 - Form 1120-C

- 15- Form 1120-F

- 16 - Form 1120-FSC

- 17 - Form 1120-H

- 18 - Form 1120-L

- 19 - Form 1120-ND

- 20 - Form 1120-ND (section 4951 taxes)

- 21 - Form 1120-PC

- 22 - Form 1120-POL

- 23 - Form 1120-REIT

- 24 - Form 1120-RIC 24

- 25 Form 1120S

- 26 - Form 1120-SF

- 27 - Form 3520-A

- 28 - Form 8612

- 29 - Form 8613

- 30 - Form 8725

- 31 - Form 8804

- 32 - Form 8831

- 33 - Form 8876

- 35 - Form 8924

- 36 - Form 8928

- Code for return that application is for:

- Part II - All Filers Must Complete This Part

- Indicate if organization if a foreign corporation that does not have an office or place of business in the United States

- Indicate if the organization is a corporation and is the common parent of a group that intends to file a consolidated return

- Indicate if organization is a corporation or partnership that qualifies under Regulations section 1.6081-5

- Applicable tax year

- Whether it is a short tax year because of:

- Initial return

- Final return

- Change in accounting period

- Consolidated return to be filed

- Other

- Tentative total tax

- Total payments and credits

- Balance due

How to file

You must file Form 7004 by the due date of your business tax return. The extension is automatic; you do not have to wait to be approved.

Corporation tax returns are due on the 15th day of the fourth month after the end of the company’s fiscal year. If a corporation’s fiscal year ends on December 31, it must file and pay its taxes or file for an extension by April 15.

For partnerships and multiple member LLCs, tax returns are due on the 15th day after the third month after the end of the partnership’s fiscal year. Tax returns for S corporations are due on the same date that the owners’ tax returns are due.

Form 7004 does not extend the time for payment of tax. You must pay estimated taxes due by your tax return due date, otherwise you may be subject to fines and penalties.

You can file Form 7004 by mail or through e-filing.