What is a Form 8109-B?

This form is used for tax filing and tax reporting purposes. The form 8109-B is known as a Federal Tax Deposit Coupon, and it is used to make deposits for payroll taxes, corporate income taxes, or other forms of taxation. This form can be used if someone is unable to pay their taxes through electronic means, such as an electronic transfer of funds.

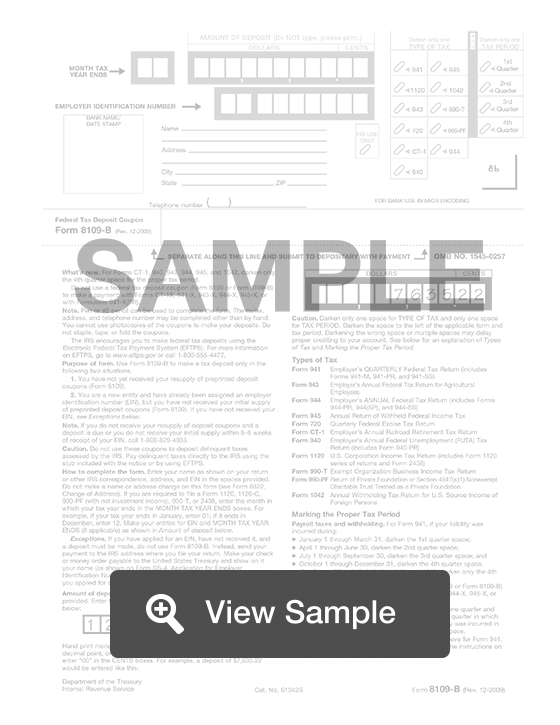

These coupons will require some basic information. You will need to include your tax identification information, such as name and social security number, so the payment can be applied to your debt. The type of tax form and the tax quarter should also be listed. The final information will come from your payment. List the amount that you are including with the tax coupon so it can be applied to your owed taxes.

A Form 8109-B should only be used if:

- You haven’t received your resupply of preprinted deposit coupons

- You are a new entity and have an EIN, but have not received your initial supply of pre printed deposit coupons

How to complete a Form 8109 B (Step by Step)

To complete a Form 8109-B, you need to provide the following information:

- Month tax year ends

- Amount of deposit

- Employer identification number

- Name

- Address

- Phone number

- Type of tax: 941, 945, 1120, 1042, 943, 990-T, 720, 990-PF, CT-1, 944, 940

- Tax period: 1st quarter, 2nd quarter, 3rd quarter, 4th quarter

You can use a pen or a #2 pencil to complete the form. You cannot use photocopies of the coupons to make your deposits. You cannot staple, tape, or fold the coupons.

The IRS encourages you to make payments via the Electronic Federal Tax Payment System (EFTPS).