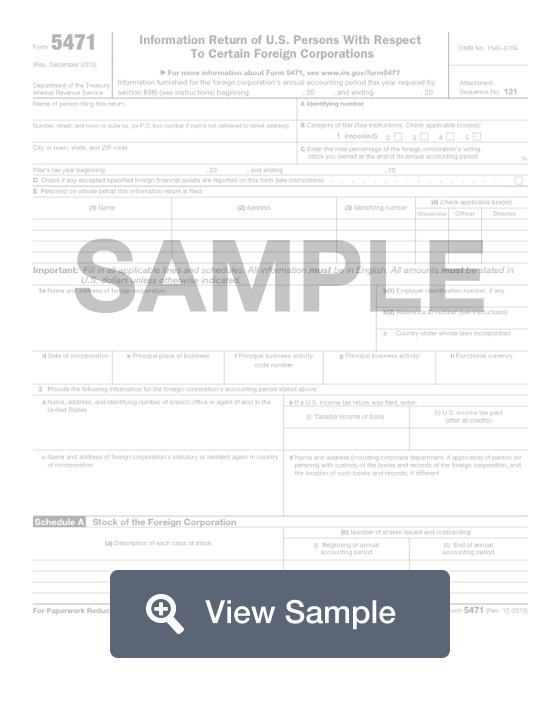

What is a Form 5471?

This form is used by the Internal Revenue Service in the United States for tax filing and reporting purposes. A Form 5471 is also known as the Information Return of U.S. Persons with Respect to Certain Foreign Corporations. It is a required form for taxpayers who are officers, shareholders, or directors in certain foreign corporations.

The information required on this form must be given in order to accurately file federal taxes. This information includes the identifying information for the filer and the foreign corporation with which they are associated. Financial information related to the filer’s U.S. earnings and foreign earnings and stocks must also be included. Using the financial information will allow you to complete the balance sheet and financial summary, which will determine your tax bracket and liabilities.

Most Common Uses

A Form 5472 is commonly used by foreign companies owned by US persons to provide information to the IRS.

Components of a Form 5471

A Form 5471 contains the following sections:

- Personal Information

- Foreign Corporation Information

- Schedule A - Stock of the Foreign Corporation

- Schedule B - U.S. Shareholders of Foreign Corporation

- Schedule C - Income Statement

- Schedule E - Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Schedule F - Balance Sheet

- Schedule G - Other Information

- Schedule H - Current Earnings and Profits

- Schedule I - Summary of Shareholder’s Income From Foreign Corporation

How to complete a Form 5471 (Step by Step)

To complete a Form 5471, you need to provide the following information:

- Personal Information

- Filing period

- Name

- Address

- Filer’s tax year

- Identifying number

- Category of filer

- Total percentage of the foreign corporation’s voting stock owned at end of annual accounting period

- Indication if any excepted specified foreign financial assets are reported on this form

- Person(s) on whose behalf return is filed

- Name

- Address

- Identifying number

- Applicable positions: shareholder, officer, director

- Foreign Corporation Information

- Name and address

- Employer identification number

- Reference id number

- Country under whose laws incorporated

- Date of incorporation

- Principal place of business

- Principal business activity code number

- Principal business activity

- Functional currency

- Name, address, identifying number of branch office or agent in United States

- Taxable income or loss and U.S. income tax paid if any

- Name and address of foreign corporation’s statutory or resident agent in country of incorporation

- Name and address of the person with custody of books and records and location of those records

- Schedule A - Stock of the Foreign Corporation

- Description of each class of stock

- Number of shares issued and outstanding at beginning and end of accounting period

- Schedule B - U.S. Shareholders of Foreign Corporation

- Name, address, identifying number of shareholder

- Description of each class of stock held by shareholder

- Number of shares held at beginning and end of accounting period

- Pro rata share of subpart F income

- Schedule C - Income Statement

- Income

- Gross receipts or sales

- Returns and allowances

- Cost of goods sold

- Gross profit

- Dividends

- Interest

- Gross rents

- Gross royalties and license fees

- Net gain or loss on sale of capital assets

- Other income

- Total income

- Deductions

- Compensation not deducted elsewhere

- Rents

- Royalties and license fees

- Interest

- Depreciation not deducted elsewhere

- Depletion

- Taxes

- Other deductions

- Total deductions

- Net Income

- Net income of loss before extraordinary items, prior period adjustments, and provision for income, war profits and excess profits taxes

- Extraordinary items and prior period adjustments

- Provision for income, war profits, and excess profit taxes

- Current year net income or loss

- Income

- Schedule E - Income, War Profits, and Excess Profits Taxes Paid or Accrued

- Name of country or U.S. possession

- Amount of tax in foreign currency

- Conversion rate

- Amount of tax in U.S. dollars

- Schedule F - Balance Sheet

- Assets

- Liabilities and Shareholders’ Equity

- Schedule G - Other Information

- Whether foreign corporation owned at least a 10% interest in any foreign partnership

- Whether the foreign corporation owned any interest in a trust

- Whether the foreign corporation owned any foreign entities that were disregarded as entities separate from their owners under Regulations sections 301.7701-2 and 301.7701-3

- Whether the foreign corporation was a participant in any cost sharing arrangement

- Whether the foreign corporation became a participant in any cost sharing arrangement

- Whether the foreign corporation participated in any reportable transaction as defined in Regulations section 1.6011-4 (attach Form 8886)

- Whether the foreign corporation paid or accrued any foreign tax that was disqualified for credit under section 901(m)

- Whether the foreign corporation paid or accrued foreign taxes to which section 909 applied or treated foreign taxes that were previously suspended under section 909 as no longer suspended

- Schedule H - Current Earnings and Profits

- Current year net income or loss per foreign books of account

- Net adjustments made to line 1 to determine current earnings and withholdings

- Capital gains or losses

- Depreciation and amortization

- Depletion

- Investment or incentive allowance

- Charges to statutory reserves

- Inventory adjustments

- Taxes

- Total net additions

- Total net subtractions

- Current earnings and profits

- DASTM gain or loss

- Current earning and profits in U.S. dollars

- Exchange rate used

- Schedule I - Summary of Shareholder’s Income From Foreign Corporation

- Name of U.S. shareholder

- Identifying number

- Subpart F income

- Earnings invested in U.S. property

- Previously excluded subpart F income

- Previously excluded expert trade income withdrawn from investment in export trade assets

- Factoring income

- Dividends received

- Exchange gain or loss on a distribution of previously taxed income

- Whether any income of the foreign corporation was blocked

- Whether any blocked income became unblocked during tax year

Filing Considerations

United States persons who are officers, directors, or shareholders in a foreign corporation are required to file Form 5471. A foreign corporation is a legal entity formed under the laws of a country other than the United States.

The only way to exempt yourself from this filing requirement is to renounce your US citizenship.

The penalties for failing to file Form 5471 or filing the form incorrectly can be quite high. An initial $10,000 penalty applies for each tax you that you fail to provide the IRS with the correct information. An additional $10,000 penalty applies if the IRS mails a notice of failure to the person and they do not provide the correct information. The maximum penalty for each failure is limited to $50,000.

Form 5471 should be attached to your income tax or corporate tax return.