What is a Form 8825?

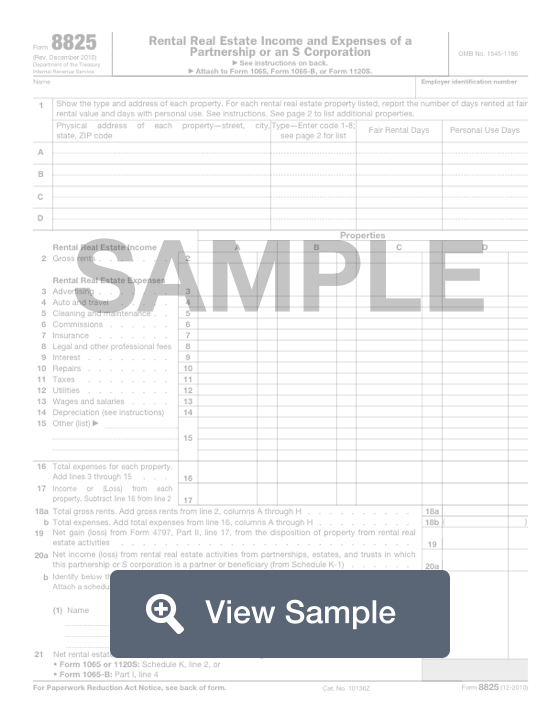

This form is related to tax filing and reporting in the United States. It will be recorded by the Internal Revenue Service. A Form 8825 is also called a Rental Real Estate Income and Expenses of a Partnership of S Corporation. This form is only used by partnerships and S corporations that engage in rental real estate activities during the tax year.

A company can list up to 8 different properties on this form. The filer will need to list the income generated from these properties, as well as the tax-deductible expenses related to the rentals. This net income and losses will determine the amount of taxes that will be owed on the properties, so be sure to accurately include everything. The financial information may also help the filer qualify for certain tax breaks.

How to complete a Form 8825 (Step by Step)

Form 8825 is meant to be attached to Form 1065 or Form 1120S.

To complete a Form 8825, you will need to provide the following information:

- Name

- Employer identification number

- Type and address of each property

- Physical address

- Type

- 1—Single Family Residence

- 2—Multi-Family Residence

- 3—Vacation or Short-Term Rental

- 4—Commercial

- 5—Land

- 6—Royalties

- 7—Self-Rental

- 8—Other (include description with the code on Form 8825 or on a separate statement)

- Fair rental days

- Personal use days

- Rental real estate income

- Rental real estate expenses

- Total gross rents

- Total expenses

- Net gain from the deposition of property from rental real estate activities

- Net income or loss from rental real estate activities from partnerships, estates, and trusts in which this partnership or an S corporation is a partner or beneficiary (from Schedule K-1)

- Partnerships, estates, or trusts from which net income or loss is shown: name, EIN