Form 941

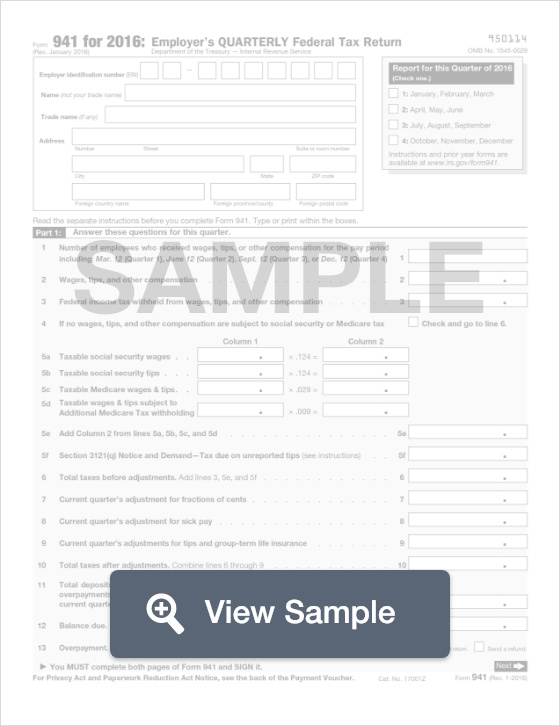

Form 941, Employer's Quarterly Federal Tax Return, is used by businesses who file their taxes on a quarterly basis. It reports information related to certain withholdings: income tax, social security tax, and Medicare tax. Because this is a quarterly tax return, the business must complete it at the end of every quarter.

What is a Form 941?

A Form 941 will be used by employers in order to report certain taxes related withheld income tax, social security tax, or Medicare tax. It is known as an Employer’s Quarterly Federal Tax Return and will be reported to the United States Internal Revenue Service. The form must be completed for each quarter of the tax year.

The filer will need to have detailed information about their company or business. This includes the employer identification number. They will need to include how many employees work for the employer, what their wages are, and how much income tax, social security tax, and Medicare tax is withheld. This financial information will be used to calculate the tax overpayment or the balance due.

Most Common Uses

IRS Form 941 is commonly used if you are a business owner and have employees working for you. As an employer, you are responsible for withholding federal income tax and other payroll taxes from each employee’s paycheck and sending it to the IRS each quarter.

Components of a Form 941

A Form 941 contains the following sections:

- Personal information

- Tax information for quarter

- Deposit schedule and tax liability for the quarter

- Business closure or seasonal employer information

- Third-party designee information

- Signature

- Paid preparer information

How to complete a Form 941 (Step by Step)

To complete a Form 941, you need to provide the following information:

- Employer identification number (EIN)

- Name

- Trade name

- Address

- Number of employees who received wages, tips, or other compensation for the pay period

- Wages, tips, and other compensation

- Federal income tax withheld from wages, tips, and other compensation

- If no wages, tips, and other compensation are subject to social security or Medicare tax

- Taxable social security wages

- Qualified sick leave wages

- Qualified family leave wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to Additional Medicare Tax withholding

- Total social security and Medicare taxes

- Section 3121(q) Notice and Demand - Tax due on unreported tips

- Total taxes before adjustments

- Current quarterâs adjustment for fractions of cents

- Current quarterâs adjustment for sick pay

- Current quarterâs adjustments for tips and group-life insurance

- Total taxes after adjustments

- Qualified small business payroll tax credit for increasing research activities

- Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

- Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 and before October 1, 2021

- Total nonrefundable credits

- Total taxes after adjustments and nonrefundable credits

- Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter

- Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

- Refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021 and before October 1, 2021

- Total deposits and refundable credits

- Balance due

- Overpayment

- Whether total taxes after adjustments and credits is less than $2,500 or was less than $2,500 on the return for the prior quarter and you didnât incur a $100,000 next-day deposit obligation during the current quarter

- Whether you are a monthly schedule depositor for the entire quarter

- Whether you were a semiweekly schedule depositor for the entire quarter

- Whether your business has closed or you stopped paying wages

- Whether you are a seasonal employer and donât have to file a return for every quarter of the year

- Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

- Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

- Qualified sick leave wages for leave taken after March 31, 2021 and before October 1, 2021

- Qualified health plan expenses allocable to qualified sick leave wages reported on line 23

- Qualified family leave wages for leave taken after March 31, 2021 and before October 1, 2021

- Qualified health plan expenses allocable to qualified family leave wages reported on line 26

- Amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 26

- Whether you authorize the IRS to speak with a third-party designee

- Designeeâs name and phone number

- Personal identification number

- Signature, printed name, date, daytime phone number

Filing Considerations

If you fail to file Form 941 on time, it may result in a penalty of 5 percent of the tax due with that return for each month or part of a month the return is late. The maximum penalty is 25 percent. A separate penalty applies for making tax payments late or paying less than is owed. The IRS will penalize you 2 to 15 percent of your underpayment, depending on how late you are paying the correct amount.

Legal Considerations

Why must my business submit Form 941 to the IRS?

If you’ve been paying employees and withholding federal income taxes and Social Security/Medicare taxes, you need to report those amounts and submit those payments to the IRS.

How to submit the Form 941

Form 941 may be submitted electronically through federal e-file. You can e-file Form 941 and pay any balance that is due using tax preparation software or working with a tax professional.

Paying taxes with Form 941

You must make monthly or semi-weekly deposits of payroll taxes collected. Do not wait until you file Form 941 to pay your taxes for the quarter. If you are required to make deposits and wait to pay the taxes with Form 941, you may be subject to a penalty for late payment.

Due dates

Form 941 is due on a quarterly basis at the end of the month following the end of the quarter. For example, for the first quarter of the year, Form 941 is due on April 30.