What is a 941-X?

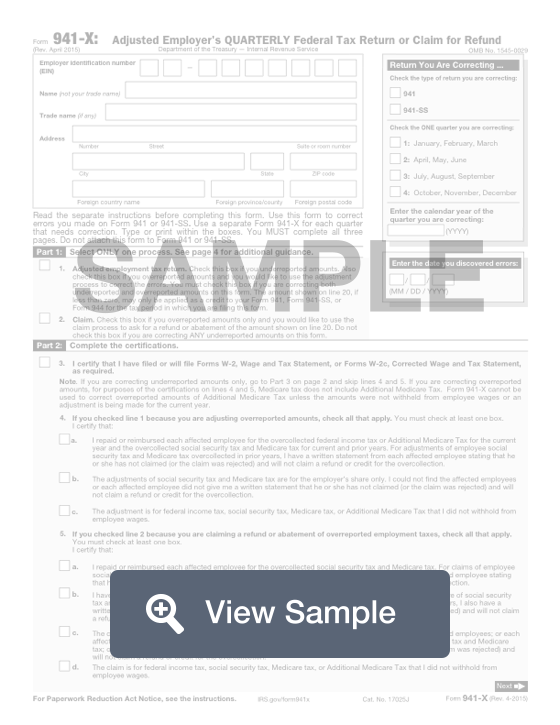

A Form 941-X is also known as an Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund form. This form is used for tax filing purposes and will be sent to the United States Internal Revenue Service. This form must be filed four times a year by certain employers who withhold income tax, social security tax, and Medicare tax from their employees.

The taxpayer will need to have a lot of information about their business or company in order to completely fill out the form. This includes the EIN, or employer identification number. The form will also require employee information including how many employees work for the employer, what their wages are, and how much income tax, social security tax, and Medicare tax is withheld from the wages. This information will be used to assess the employer and calculate taxes owed or refunded.

How to complete a 941-X (Step by Step)

To complete a Form 941-X, you will need to provide the following information:

- Employer identification number (EIN)

- Name

- Trade name

- Address

- Type of return you are correcting (941, 941-SS)

- Quarter and year you are correcting

- Type of process: adjusted employment tax return, claim

- Certifications:

- Filed or will file Forms W-2 or Forms W-2c

- If adjusting over reported amounts:

- Repaid or reimbursed each affected employee, written statement that each affected employee hasn’t and won’t claim refund for overcollection for past years

- Adjustments of social security tax and Medicare tax are for employer’s share only, couldn’t find employees or written statement that each affected employee hasn’t and won’t claim refund for overcollection

- Adjustment for federal income tax, social security tax, of additional Medicare tax that employer does not withhold

- If claiming a refund or abatement:

- Repaid or reimbursed each affected employee, written statement that each affected employee hasn’t and won’t claim refund for overcollection for past years

- Written consent for each affected employee stating that employer may file claim for employee’s share of social security tax and Medicare tax, written statement that each affected employee hasn’t and won’t claim refund for overcollection for past years

- Claim for social security tax and Medicare tax are for employer’s share only, couldn’t find employees or written statement that each affected employee hasn’t and won’t claim refund for overcollection

- Claim for federal income tax, social security tax, of additional Medicare tax that employer does not withhold

- Corrections for:

- Wages, tips, other compensation

- Federal income tax withheld from wages, tips, other compensation

- Taxable social security wages

- Taxable social security tips

- Taxable Medicare wages and tips

- Taxable wages and tips subject to additional Medicare tax withholding

- Section 3121(q) Notice and Demand - tax due on unreported tips

- Tax adjustments

- Qualified small business payroll tax credit for increasing research activities

- Special addition to wages for federal income tax

- Special addition to wages for social security taxes

- Special addition to wages for additional Medicare tax

- COBRA premium assistance

- Number of individuals provided with COBRA premium assistance

- Total

- Amount owed

- Explanation for corrections for the quarter

- Indication if corrections entered include both underreported and overreported amounts

- Indication if corrections involve reclassified workers

- Details explanation of how corrections were calculated

- Signature, printed name, title, date, phone number

- Paid preparer information

- Name

- Signature

- PTIN

- Date

- Firm’s name

- EIN

- Address

- Phone

Common Errors

How to correct errors on a 941-X

Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund is used to correct errors on Form 941. It is a standalone form. Each line on Form 941-X relates to a line on Form 941.

Legal Considerations

When to file Form 941-X

Form 941 is due on a quarterly basis at the end of the month following the end of the quarter. For example, the first quarter of the year end on March 31, so Form 941 should be submitted by April 30 for the first quarter.

You can file Form 941-X at any time you discover an error. You don’t have to wait until the end of the quarter to file it with the next employment tax return.