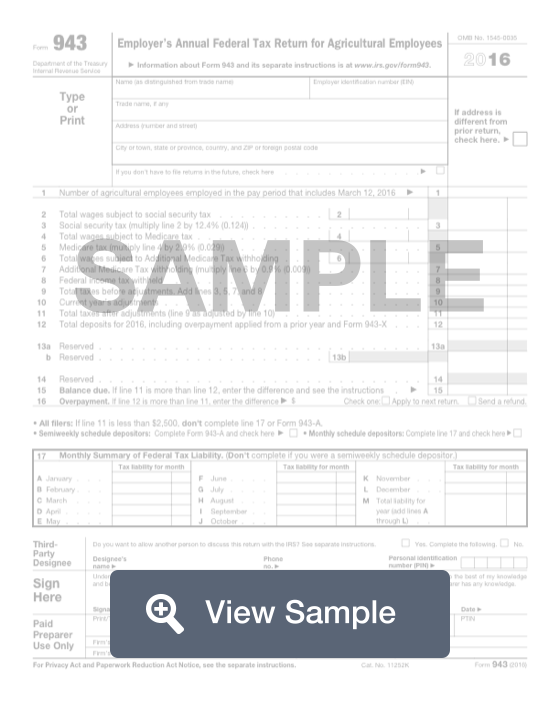

What is a Form 943?

This form will be used by employers in the agricultural field. It is known as an Employer’s Annual Federal Tax Return for Agriculture Employees. The form will be sent to and recorded by the United States Internal Revenue Service. This form should be completed yearly by any employer who withholds income tax, social security tax, or Medicare tax from their employees.

This form will require information about the agricultural business or company. This includes the total wages paid, the total income tax, social security tax, and Medicare tax withheld, and any adjustments for the tax year. This will allow the filer to calculate the amount of taxes they owe or will be refunded. Before sending the form, ensure it has been signed by the preparer, whether it was an individual party or a paid tax professional.

How to complete a Form 943 (Step by Step)

To complete a Form 943, you will need to provide the following information:

- Name

- Employer identification number (EIN)

- Trade name

- Address

- Indication if address is different from prior return

- Indication if you don’t have to file returns in the future

- Number of agricultural employees employed in the pay period

- Total wages subject to social security tax

- Additional Medicare Tax withholding

- Federal income tax withheld

- Total taxes before adjustments

- Current year’s adjustments

- Total taxes after adjustments

- Qualified small business payroll tax credit for increasing research activities

- Total taxes after adjustments and credits

- Total deposits for 2018, including overpayment applied from prior year and Form 943-X

- Balance due

- Overpayment

- Total taxes after adjustments and credits less than $2,500 (don’t complete Form 943-A or monthly summary of federal tax liability), semi-weekly depositor (complete Form 943-A) or monthly depositor (complete monthly summary of federal tax liability)

- Third-party designee information

- Signature

- Paid preparer information

- Payment voucher

- EIN

- Amount of payment

- Business name

- Address