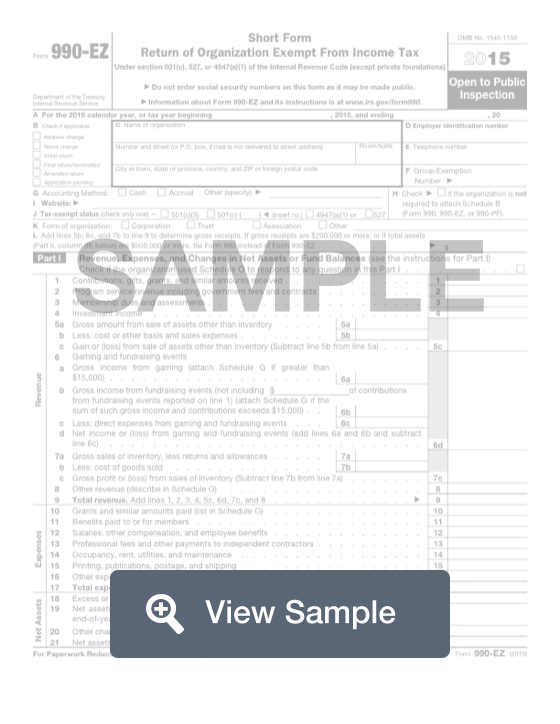

What is a 990 EZ?

A Form 990-EZ is also known as an “easy” Short Form Return of Organization Exempt from Income Tax. This form is used for tax filing purposes, and it will be sent to the United States Internal Revenue Service. Tax exempt organizations, non-exempt charitable trusts, and certain political organizations will use this form to report their earnings and losses to the IRS.

Like a standard federal tax return, this form requires detailed financial information. The organization should fill the sections about revenue and expenses out fully. This includes contributions and gifts received, dues, and investment income. Expenses should include cost of goods and events, salaries, and rent. This financial information will allow the IRS to review your organization each year and ensure there is no tax fraud going on.

How to complete a 990 EZ (Step by Step)

To complete a Form 990-EZ, you will need to provide the following information:

- Personal information

- Tax year

- Special circumstances for return: address change, name change, initial return, final return/terminated, amended return, application pending

- Name of organization

- Address

- Employer identification number (EIN)

- Telephone number

- Group exemption number

- Accounting method: cash, accrual, other

- Indication if organization is not required to attach Schedule B (Form 990, 990-EZ, or 990-PF)

- Form of organization: corporation, trust, association, other

- Gross receipts (if $200,000 or more or if total assets are $500,000 or more, file Form 990 instead)

- Part I - Revenue, Expenses, and Changes in Net Assets or Fund Balances

- Revenue

- Contributions, gifts, grants, and other similar amounts

- Program service revenue including government fees and contracts

- Membership dues and assessments

- Investment income

- Gain or loss from sale of assets other than inventory

- Gross amount from sale of assets other than inventory

- Cost or other basis and sales expenses

- Gaming and fundraising events

- Gross income from gaming (attach Schedule G if greater than $15,000)

- Gross income from fundraising events not including contributions from fundraising event reported on line 1

- Direct expenses from gaming and fundraising events

- Net income or loss from gaming and fundraising events

- Gross profit or loss from sales of inventory

- Other revenue (describe in Schedule O)

- Total revenue

- Expenses

- Grants and other similar amounts paid

- Benefits paid to or for members

- Salaries, other compensation, and employee benefits

- Professional fees and other payments to independent contractors

- Occupancy, rent, utilities, and maintenance

- Printing, publications, postage, and shipping

- Other expenses

- Total expenses

- Net assets

- Expenses or deficit for year

- Other changes in net assets or fund balances

- Net assets or fund balances at beginning of year

- Revenue

- Part II - Balance Sheets

- Cash, savings, and investments

- Land and buildings

- Other assets

- Total assets

- Total liabilities

- Net assets or fund balances

- Part III - Statement of Program Service Announcements

- Indication if organization used Schedule O to response to any question in this part

- Organization’s primary exempt purpose

- Program service accomplishments for each of its three largest program services, by expenses

- Grant amount, indication if amount includes foreign grants

- Total program service expenses

- Part IV - List of Officers, Directors, Trustees, and Key Employees

- Name and title

- Average hours per week dedicated to position

- Reportable compensation

- Health benefits, contributions to employee benefit plans, and deferred compensation

- Estimated amount of other compensation

- Part V - Other Information

- Whether the organization engaged in significant activity not previously reported to IRS

- Significant changes in organizing or governing documents

- Unrelated business gross income of $1,000 or more from business activities during the year, filed Form 990-T, section 501(c)(4), 501(c)(5), or 501(c)(6) organization subject to section 6033(e) notice, reporting and proxy tax requirements (compete Schedule C, Part III)

- Liquidation, dissolution, termination or significant disposition of net assets during year (Schedule N)

- Political expenditures, Form 1120-POL

- Borrow from, make loans to, or have outstanding loans with any officer, director, trustee, or key employee (Schedule L)

- Section 501(c)(7) organization initiation fees and capital contributions, gross receipts for public use of club facilities

- Section 501(c)(3) tax imposed under section 4911, section 4912, section 4955

- Section 501(c)(3), 501(c)(4), and 501(c)(29) organization engaged in any section 4958 excess benefit transaction during the year or prior years that has not been reported on prior Forms 990 or 990-EZ (Schedule L, Part I)

- Section 501(c)(3), 501(c)(4), and 501(c)(29) organizations tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958

- Section 501(c)(3), 501(c)(4), and 501(c)(29) organizations tax imposed on the organization managers or disqualified persons during the year under sections 4912, 4955, and 4958 reimbursed by organization

- Whether organization was party to a prohibited tax shelter transaction (Form 8886-T)

- States where copy of this return is file

- Organization’s books in care of

- Whether organization had an interest in or signature or other authority over a financial account in a foreign country (such as a bank account, securities account, or other financial account)

- Whether organization had an office outside the United States

- Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041, indicate amount of tax-exempt interest received or accrued during the year

- Whether organization maintain any donor advised funds during year (Form 990)

- Whether organization operated one or more hospital facilities during the year (Form 990)

- Whether organization received payment for indoor tanning services during year (Form 720)

- Whether organization had a controlled entity under section 512(b)(13)

- Whether organization received any payment from or engaged in any transaction with a controlled entity under 512(b)(13) (Form 990 and Schedule R)

- Whether the organization engaged in political campaign activities on behalf of or in opposition to candidates for public office (Schedule C, Part I)

- Part VI - Section 501(c)(3) organizations only

- Whether the organization engaged in lobbying activities or had a section 501(h) election in effect during the tax year (Schedule C, Part II)

- Whether the organization is a school under section 170(b)(1)(A)(ii) (Schedule E)

- Whether the organization made any transfers to an exempt non-charitable related organization

- Whether the related organization was a section 527 organization

- Five highest compensated employees (other than officers, directors, trustees, key employees) who received more than $100,000 in compensation

- Name and title

- Average hours per week

- Reportable compensation

- Health benefits, contributions to employee benefit plans, deferred compensation

- Estimated amount of other compensation

- Total number of employees paid over $100,000

- Five highest compensated independent contractors who received more than $100,000 of compensation

- Name and business address

- Type of service

- Compensation

- Total number of independent contractors receiving over $100,000

- Schedule A

- Signature

- Signature

- Name and title

- Date

- Paid preparer information

- Name

- Signature

- Date

- PTIN

- Firm’s name

- Firm’s address

- Firm’s EIN

- Phone number

- Authorization for IRS to discuss return with prepare

Filing Requirements

The Form 990-EZ is due on the 15th day of the 5th month following the end of the fiscal year. There is a paper version of the form which may be filed by mail and an electronic version that may be filed online.

To qualify for a Form 990-EZ, a nonprofit organization should have a gross income of more than $50,000, but less than $200,000 during the past fiscal year. The total value of all of the organization’s assets should be less than $500,000.