What is an LLC 12?

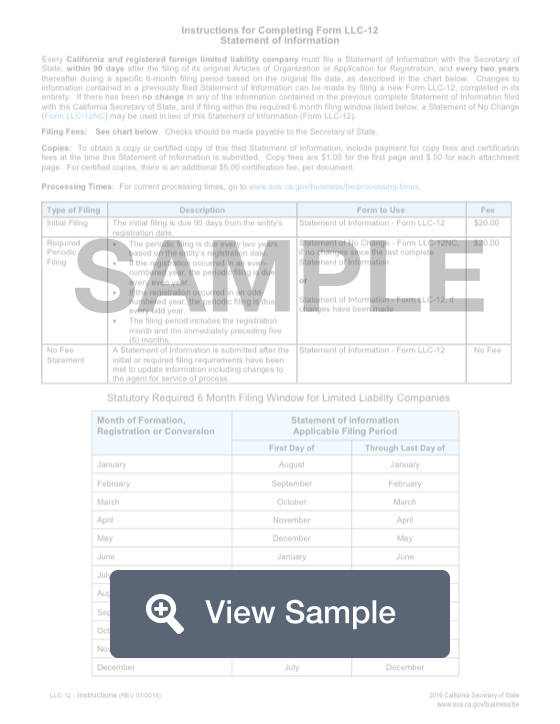

This form is used by the state of California for recording information related to limited liability companies, or LLCs. This form is known as a Statement of Information and should be filed after an LLC completes a form LLC-1. After filing the LLC-1 document, companies have 90 days to complete and file a Form LLC-12. After this, the form is filed every two years.

This form will require the name of the limited liability company, their file number, and their location in the state of California. If the information hasn’t changed since the last time you filed a Form LLC-12, you can check the box to complete the form. Otherwise, list the information for your company, including address, CEO, managers, and more

Most Common Uses

Form LLC-12 is commonly used to help the state of California track changes in addresses, agents, managers, and members of Limited Liability Companies. The form, which was formerly called LLC-12R, is also known as the Statement of Information or SOI, form.

Components of a LLC 12

An LLC-12 contains the following sections:

- Company information

- Business addresses

- Manager(s) or member(s) information

- Service of process

- Type of business

- Chief executive officer

- Signature

How to complete a LLC 12 (Step by Step)

To complete an LLC-12, you will need to provide the following information:

- Company information

- Limited liability company name

- 12-digit secretary of state entity (file) number

- State, foreign country, or place of organization

- Business addresses

- Street address of principal office

- Mailing address of LLC

- Street address of California office

- Manager(s) or member(s) information

- Name of individual or entity

- Address

- Service of process

- California agent’s name

- Street address

- California registered corporate agent’s name

- Type of business

- Describe the type of business or services

- Chief executive officer

- Name

- Address

- Signature

- Date

- Name

- Title

- Signature

Filing an LLC 12

Any authorized company member can file the form. You can submit Form LLC-12 to the California Secretary of State online or fill out a paper form and mail it to the Secretary of State.

Companies who have more than one manager or member should attach the details of additional managers and members to their LLC-12 forms using the Attachment to Statement of Information of Form LLC-12A.

All LLCs are required to file form LLC-12 within 90 days of filing the Articles or Organization or Application for Registration and every two years thereafter. Companies must file the form at the due date whether the company is actively conducting business or not.

If an LLC misses its filing deadline, there will be a $250 fine for late filing.