What is a SSA 521?

A Form SSA-521 is known as a Request for Withdrawal of Application. It will be recorded and received by the Social Security Administration. This form will be used if you change your mind about applying to receive social security retirement benefits. You can file this form before you are due to start receiving your retirement benefits, but not after you have been receiving benefits for 12 or more months. You can only withdraw from retirement benefits once in your lifetime.

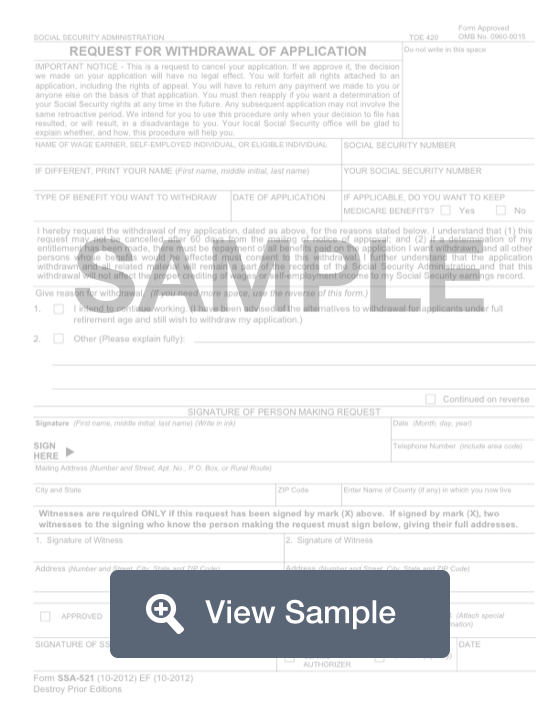

This form will require your personal information so you can be identified by the Social Security Administration. You will also need to include the reason why you want to withdraw from your application. Typically this is because you will continue working. If it is due to another reason, write it in on the form. You will need to sign this form, and a witness will sign as well.

Most Common Uses

A Form SSA-521 is commonly used by individuals who have claimed their retirement benefits and have, within 12 months, decided that they would rather not receive benefits. This will allow the individual’s benefits to continue to grow. This is usually done when an individual decides to go back to work or receives a large sum of money.

How to complete an SSA 521 (Step by Step)

To complete a SSA-521, you need to complete the following items:

- Name

- Social security number

- Type of benefit you wish to withdraw

- Date of application

- Whether you want to keep Medicare benefits

- Reason for withdrawal

- Signature of person making the request

- Date

- Phone number

- Mailing address

- Witnesses’ signatures and address

Withdrawing your application

If you begin to receive social security benefits and change your mind within 12 months, you may be able to withdraw your claim and file it again at a later date. You are only entitled to withdraw your claim once in your lifetime.

To withdraw your application, you must repay all of the benefits that you have received. To begin the process, fill out Social Security Form SSA-521. In your application, you will need to include the reason that you wish to withdraw your application.

You should then send your completed form to the Social Security Administration. The SSA will notify you when there is a decision about your withdrawal request. You have 60 days to cancel an approved withdrawal.