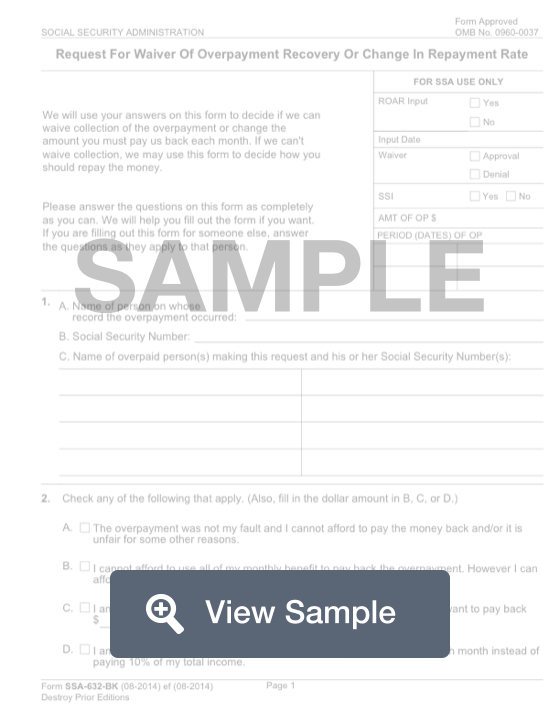

What is a SSA 632?

This form is used by the Social Security Administration. The Form SSA 632-BK will be a Request for Waiver of Overpayment Recovery or Change in Repayment Rate. This form will be filed by someone who owes the Social Security Administration money due to an overpayment. This form will allow you to either request the SSA reconsider the overpayment, waive the payment, or request a different rate.

You will need to include the reason why you want to change or waive the overpayment amount. You will also need to include your financial information. This will allow the Social Security Administration to determine whether or not it is reasonable to ask that you repay them. Make sure you know how much you pay for rent or your mortgage, utility bills, and other expenses. Including these can help the SSA make an informed decision.

How to complete an SSA 632 (Step by Step)

To complete a SSA-632-BK, you will need to provide the following information:

- Name

- Social security number

- Name of overpaid person making request and his or her social security number(s)

- Indicate if any of the following apply:

- The overpayment was not my fault and I cannot afford to pay the money back and/or it is unfair for some reason

- I cannot afford to use all of my monthly benefit to pay back the overpayment, but can have a specific amount withheld each month

- I am no longer receiving Supplemental Security Income (SSI) payments and want to pay back a certain amount each month

- I am receiving SSI payments and want to pay back a certain amount each month instead of paying 10% of my total income

- Section I - Information About Receiving the Overpayment

- Whether the representative payee received the overpaid benefits to use for the beneficiary

- Name and address of beneficiary

- How overpaid benefits were used

- If you are being asked to repay someone else’s overpayment

- Whether the overpaid person was living with you when he or she was overpaid

- Whether you received any of the overpaid money

- Explanation of what you knew about the overpayment and why it was not your fault

- Reason why you think you were due the overpaid money and why you think you were not at fault in causing the overpayment or accepting the money

- Whether you told the SSA about the change or event that made you overpaid

- Whether you have been overpaid before and explanation

- Whether the representative payee received the overpaid benefits to use for the beneficiary

- Section II - Your Financial Statement

- If you are asking the SSA to waive the collection of the overpayment of change the rate of repayment, you must provide the following information and supporting documents

- Whether you have any of overpaid checks or money in your possession

- Whether you have any of the overpaid checks or money in your possession at the time you received the repayment notice

- Explanation why you believe you should not have to return this amount

- If overpayment is SSI payments, whether you lent or gave away any property or cash after notification of the repayment, who received it, relationship, description, and value

- If overpayment is SSI payments, whether you received or sold any property or received cash other than earnings after notification of overpayment, description of property, and sale price

- Whether you are now receiving cash public assistance such as SSI payments

- If you are asking the SSA to waive the collection of the overpayment of change the rate of repayment, you must provide the following information and supporting documents

- Members Of Household

- Name

- Age

- Relationship

- Assets - Things You Have and Own

- Amount of money you and any of the members in your household have on hand in a checking account, or otherwise readily available

- Whether your name or any other member of your household appear on any of the following:

- Savings, certificates of deposit, individual retirement account, money or mutual funds, bonds, stocks, trust fund, checking account, or other similar account

- Owner

- Balance or value

- Income earned each month

- Explanation

- Any vehicles owned by a household member other than the family vehicle

- Owner

- Year/make/model

- Present value

- Loan balance

- Main purpose for use

- Any real estate owned by household other than primary residence

- Owner

- Description

- Market value

- Loan balance

- Usage-income

- Monthly Household Income

- Whether you are employed

- Employer’s name, address phone

- Monthly pay before deduction

- Monthly take-home pay

- Whether your spouse is employed

- Employer’s name, address phone

- Monthly pay before deduction

- Monthly take-home pay

- Whether any other household member is employed

- Employer’s name, address phone

- Monthly pay before deduction

- Monthly take-home pay

- Whether you, your spouse, or any dependent member of your household receive support or contributions from any person or organization

- Amount of money received each month

- Source

- Income

- Take home pay

- Social security benefits

- Supplemental security income (SSI)

- Pension

- Public assistance

- Food stamps

- Income from real estate

- Room and board payments

- Child support/alimony

- Other support

- Income from other assets

- Other

- Whether you are employed

- Monthly Household Expenses

- Rent or mortgage

- Food

- Utilities

- Other heating/cooking fuel

- Clothing

- Credit card payments

- Property tax

- Other taxes or fees related to home

- Insurance

- Medical-dental

- Car operation and maintenance

- Other transportation

- Church-charity cash donation

- Loan, credit, lay-away payments

- Support to someone not in household

- Any expense not shown above

- Income and Expenses Comparison

- Monthly income

- Monthly expenses

- Adjusted household expenses

- Adjusted monthly expenses

- If expenses are more than your income, explain how you are paying your bills.

- Financial Expectation and Funds Availability

- Whether you or your spouse or any dependent member of your household expect your or their financial situation to change (for the better or worse) in the next 6 months

- Whether there is an amount of cash on hand or in checking accounts or is it being held for a special purpose

- Whether there is any reason you cannot convert to cash Balance or Value of any financial asset shown above

- Whether there is any reason you cannot sell or otherwise convert to cash any of the assets shown above

- Signature

- Date

- Work phone number

- Home phone number

- Mailing address

- Name of county where you live

- Signature and address of witnesses