What is an Income Statement?

An income statement is a financial document that is shows the financial performance of an individual or business over a specific period of time. Income statements are very important to financial management because they show whether a person or business is profitable. This determination can influence decisions related to credit, borrowing, and investing. If a business owner is spending more money than they are earning, investors and lenders will be able to manage their risk using this document.

An income statement is also known as a profit or loss statement. The income statement outlines financial income and debts for a specific accounting period. This period of time could be a year, a month, or any other time period. Only the financial losses and profits for this time period will be included on the income statement. An income statement does not include cash income or distributions.

Income Statement vs Balance Sheet

An income statement presents a summary of expenses and income over a period of time (usually one year). An income statement shows the result of a business’ operations.

A balance sheet provides the financial position of a company at a specific point in time. The balance sheet is often much more detailed than an income statement. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity.

Profit and Loss vs Income Statement

There is no difference between a Profit and Loss Statement (P&L) and an Income Statement. These two terms may be used interchangeably.

Cash Flow vs Income Statement

A cash flow statement shows the actual cash received and spent during a specific period of time. It shows the current liquid assets of a company at a certain point in time.

The difference between a cash flow statement and an income statement is that an income statement also takes into account some non-cash accounting items, such as depreciation.

Types of income statements

Simple/Basic

A simple or basic income statement will often only include income, expenses, and net profit or loss. Simple income statements are usually sufficient for most small businesses. Investors may request more complex income statements.

Single Step

A single-step income statement is a basic income statement. It lists all revenues, then all expenses, then net profit or loss. There are no sub-totals listed for items such as gross profit, operating income, or earnings before taxes. Single-step income statements are commonly used by both small and large companies.

Multi Step

A multi-step income statement provides a more complete overview of a company’s financial situation. A multi-step income statement uses multiple subtractions to compute the net income shown on the bottom line. In these statements, operating and non-operating activities are listed separately. Gross profit, operating income, non-operating income, and net income are listed as individual line items on these statements.

Pro Forma

A pro forma income statement is based upon assumptions and projections. A company may use a pro forma income statement to forecast what may happen if a certain event occurs. For example, a company may use a pro forma income statement to see the effects of different financing options or the results of a merger.

Common Size

A common size income statement is used to analyze how each separate item in an income statement affects a company’s overall profit. Each account is expressed as a percentage value of net sales.

Contribution Margin

A contribution margin (CM) or dollar contribution per unit is an accounting tool that lets a company determine the profitability of certain products. A contribution margin is the selling price per unit minus the variable cost per unit. A company’s contribution margin includes all earnings that are available to pay for fixed expenses. If any earnings remain, the difference is profit. A contribution income statement is generally used as an internal tool for planning and analyzing product costs.

Absorption Costing

Absorption costing is a method of expensing all costs that are associated with manufacturing a particular product. Absorption costing is the standard format for income statements and is required according to Generally Accepted Accounting Principles (GAAP).

Variable Costing

Variable costing is an accounting method that only assigns variable costs to inventory (costs such as materials, labor, overhead variances). This means that any remaining manufacturing overhead are considered periodic expenses.

Partial

A partial income statement only reports financial information for a specific period of time. This tends to be a special-purpose document that is only used once. A partial income statement typically reports all the same information that is included in a full income statement.

CVP

A Cost-Volume-Profit (CVP) income statement is an internal document that is used to analyze the profitability of certain scenarios. A CVP statement typically takes into account: sales mix, variable costs, fixed costs, selling price per unit, and volume of activity.

Segmented

A segmented income statement breaks down an income statement into different categories. Each category is placed on a separate line in an Excel spreadsheet. These types of income statements are typically used to determine the profitability of a certain segment of a company. For example, a segment may be one product line of the company. Management may use this segmented income statement to analyze the profitability of that product line and to decide whether to keep manufacturing it.

Comparative

A comparative income statement combines the information from several income statements into one document. It helps you identify financial trends and measure performance over time. For example, a comparative income statement might include the past five years. Using this information, management can track trends in revenue, expenses, and profit over time.

Projected

A projected income statement is a budgetary tool that is used to estimate the results that you will see from your business at a future point in time. To create a projected income statement, it is important to take into account revenues, costs of goods sold, gross profit, and operating expenses. A projected income statement differs from a pro forma statement because a pro forma statement makes assumptions based upon a possible event; a projected income statement assumes that operations will continue as usual.

Consolidated

A consolidated income statement is used by a parent company with subsidiaries to show a complete overview of the company’s financial position as a whole. In a consolidated income statement, the assets, liabilities, equity, income, expenses, and cash flows of the parent company and its subsidiaries are presented as those of a single entity.

Components of an Income Statement

- Revenues - Income that a company receives during a period of time.

- Business Expenses - Any expenses that a company incurs. This includes costs of goods sold (COGS), operating expenses, etc.

- Operating Income - Amount of revenue left after deducting operating costs from sales revenue. This is also referred to as operating profit or Earnings Before Interest & Taxes (EBIT).

- Income from Continuing Operations - This is the operating income minus interest expense and income tax, plus/minus and non-operating revenues, expenses, gains, and losses.

- Below-the-line Items - Some income is included “below-the-line” because they are not expected to occur in the future. This would include income from discontinued operations, extraordinary items, and the effect of accounting changes. “Below-the-line” refers to the fact that the items do not directly affect a firm’s reported profits.

Definitions surrounding income statements

Income Statement Formula

The income statement formula is: Net Income = Revenue - Expenses

Generally accepted accounting principles (GAAP) require a business to use the accrual method of accounting. This means that revenue is matched with expenses that occur in each month.

Relationship to cash flow

The accrual method means that the statement of cash flows is not directly connected to activity in the income statement. Revenues and expenses are posted each month, regardless of when cash moves into or out of a business.

Operating vs Non Operating Income

The income statement formula (Net income = Revenue - Expenses) can be used to produce a single-step income statement. However, companies that need their business results to be analyzed in more detail use multiple-step income statements.

Multiple step income statements separate operating income and expenses from non-operating income and expenses. Operating income and expenses are transactions that relate to the day-to-day operations of a business.

Analyzing operating income separately from non-operating income is important because consistent operating income is required for a business to be successful over time. Non-operating income is unusual income that cannot be relied upon year after year.

How to make an income statement

Single Step Income Statement

A single-step income statement contains three main sections:

- Revenues - All of the company’s income

- Expenses - All of the company’s expenses

- Net Income - Total expenses subtracted from total revenue. This is called net income or “the bottom line.” This sections states whether a company had a total net gain or loss.

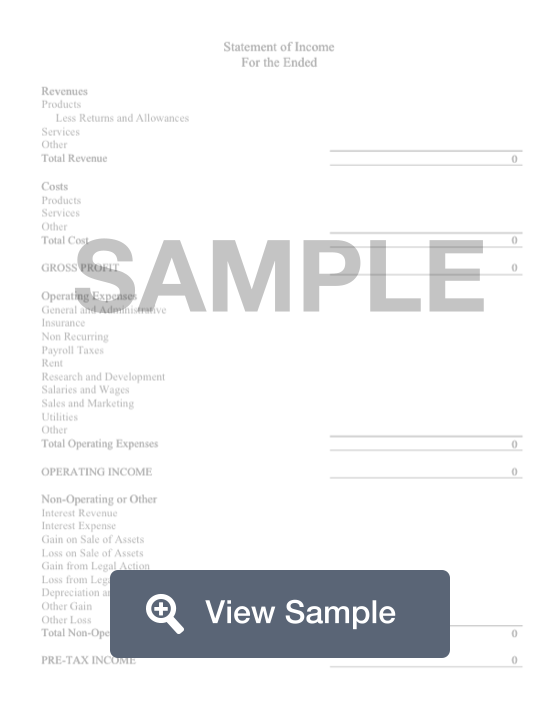

Multi Step Income Statement

A multi-step income statement contains information about a company’s operating revenue and expenses, which are separated from non-operating revenue and expenses. A multi-step income statement also includes a line item for gross profit.

A multi-step income statement includes:

- Sales - Total sales or cost of goods sold (COGS) and resulting gross profit.

- Operating Expenses - A breakdown of all the operating expenses of a company, including its Selling, General, and Administrative Expenses (SG&A).

- Operating Income - the difference between gross profit and total operating expenses.

- Non-Operating/Other - Revenue, expense, gain or loss related to non-operating activities. This includes income and expenses like interest, lawsuit settlements, extraordinary items, and gains or losses from investments.

- Net Income - Resulting net profit or loss, This is calculated by adding operating income and non-operating income.