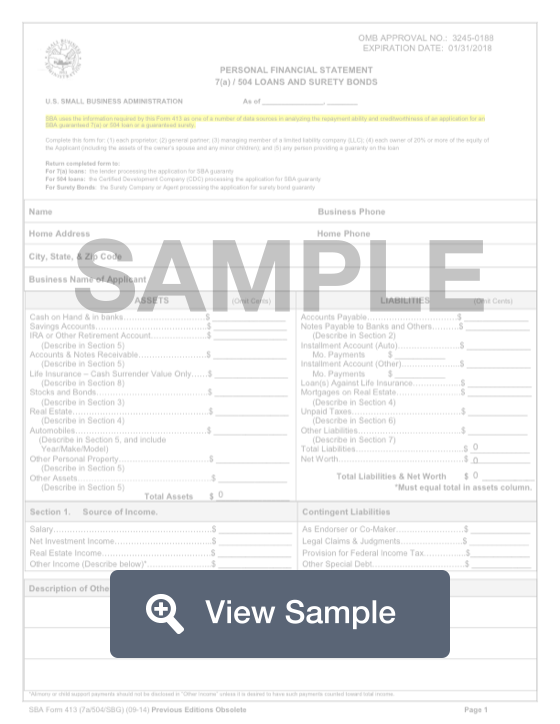

What is an SBA 413?

An SBA Form 413 is known as a Personal Financial Statement. It will be used by the United States Small Business Administration. This form needs to be completed by each proprietor for the business, as well as each partner or stockholder who owns 20% or more interest or stocks and any party who has given a guaranty on the business’ loan.

Each will need to include their personal identifying information and contact information. The next section will be for the personal financial information. That will include the party’s assets and liabilities. Assets such as stocks, real estate, and other taxes should be listed individually. Liabilities including unpaid taxes should also be described in detail. The SBA will verify this information to determine the state of the party’s finances and their creditworthiness.

Most Common Uses

The SBA Form 413 is commonly used by all SBA 7(a) or SBA 504 loan applicants. Each of the following people must complete SBA Form 413:

- Sole proprietors

- General partners

- Managing members of LLCs

- Owners of 20% or more of a business

- Any person or entity providing a guarantee on a loan

Components of a SBA 413

A SBA 413 contains the following sections:

- Personal Information

- Assets

- Liabilities

- Source of Income

- Contingent Liabilities

- Notes Payable to Banks and Others

- Stocks and Bonds

- Real Estate Owned

- Other Personal Property and Other Assets

- Unpaid Taxes

- Other Liabilities

- Life Insurance Held

- Certification

Definitions and Terms

Some important terms on the SBA 413 include:

- “As of” date - effective date of the information that is provided on the SBA personal financial statement

- Name - if you are married and file a joint return, both you and your spouse’s name must be on the form

- Business phone - should be a direct line

- Home phone - can also be a mobile phone number

- Home address - current address

- Business name of applicant - as shown on your most recent business federal tax return

What paperwork do you need to complete SBA form 413?

When you complete your SBA Form 413, you should gather the following documents:

- Checking and savings account statements

- IRA, 401(k), and other retirement account statements

- Life insurance documents

- Stocks, bonds, and other investment documents

- Pay stubs

- Statements for disability income, pensions, other sources of income

- Mortgage statements, auto loan statements, credit card statements, other loan documents

Assets

The assets section of SBA Form 413 summarizes information that you provided in prior steps and includes new information. Amounts should be rounded up to the nearest dollar.

Liabilities

Contingent liabilities are debts that will become your responsibility if a certain event happens. In the liabilities portion of SBA Form 413, you are summarizing the contingent liabilities reported in the Other Liabilities section.

How to complete an SBA 413 (Step by Step)

To complete an SBA Form 413, you need to provide the following information:

- Personal Information

- Name

- Address

- Business name of applicant

- Business phone

- Home phone

- Assets

- Cash on hand and in banks

- Savings accounts

- IRA or retirement accounts

- Accounts and notes receivable

- Stocks and bonds

- Real estate

- Automobiles

- Other personal property

- Other assets

- Liabilities

- Accounts payable

- Notes payable to banks and others

- Installment accounts (auto and other)

- Loans against life insurance

- Mortgages on real estate

- Unpaid taxes

- Other liabilities

- Net worth

- Source of Income

- Salary

- Net investment income

- Real estate income

- Other income

- Contingent Liabilities

- As endorser or co-maker

- Legal claims and judgments

- Provision for federal income tax

- Other special debt

- Notes Payable to Banks and Others

- Names and addresses of noteholders

- Original balance

- Current balance

- Payment amount

- Frequency

- How secured or endorsed, type of collateral

- Stocks and Bonds

- Number of shares

- Names of securities

- Cost

- Market value, quotation/exchange

- Date of quotation/exchange

- Total value

- Real Estate Owned

- Type of real estate

- Address

- Date purchased

- Original cost

- Present market value

- Name and address of mortgage holder

- Mortgage account number

- Mortgage balance

- Amount of payment per month/year

- Status of mortgage

- Other Personal Property and Other Assets

- Description, name and address of lien holder, amount of lien, terms of payment, any delinquency

- Unpaid Taxes

- Type, to whom payable, when due, amount, to what property, whether a tax lien attaches

- Other Liabilities

- Describe in detail

- Life Insurance Held

- Give face amount and cash surrender value of policies

- Name of insurance company and beneficiaries

- Certification

- Signature

- Name

- Date

- Social security number

Legal Considerations

Does my spouse have to be included?

If you are married and file a joint tax return, your name and your spouse’s name should be on the form. You must report all joint assets and liabilities on the form, unless you have a legal document such as a prenuptial agreement that specifically separates certain assets.

Can I exclude any assets?

If you exclude assets, they may be found in a background check. Excluding assets could hurt your relationship with your loan provider.

Do I include all of my life insurance as an asset?

You only need to include certain types of life insurance policies that offer a cash surrender value upon cancellation.

How do I determine the value of personal property?

The value of your personal property items is an estimate of the value that your would receive if you sold the item tomorrow.

When do I provide documentation for claims on the forms

You do not need to provide documentation for claims on your Form 413. Your loan provider may ask for supporting documentation during their due diligence phase.

What do I do after filling out the form?

Once you have completed the form, you should be sure that you have signed and dated it. Put it in a binder with the supporting documents. Be prepared to provide your lenders with copies upon request.