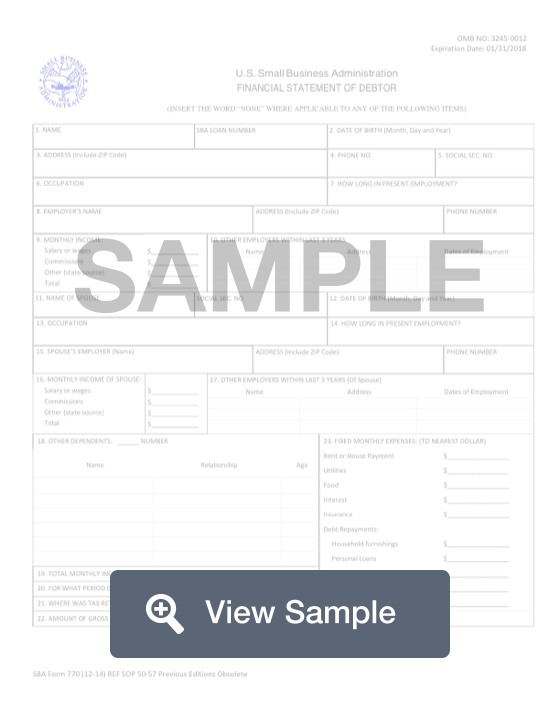

What is an SBA Financial Statement of Debtor?

This form will be used by the United States Small Business Administration. The SBA Form 770 is a Financial Statement of Debtor, and it will be used to gain in-depth financial information about a party who owes a debt. This form will require many personal details about monthly income and liabilities. This will allow the SBA to evaluate the party’s ability to repay their debt

This form is typically filed in order for a debtor to see if they are eligible for a debt consideration program. This can help the filer to repay their debt. In order to be considered, you must include detailed financial information. This includes your current job, your monthly salary and other income, and your monthly expenses. This will allow the Small Business Administration to find a payment plan that will work for you and your budget.

How to complete an SBA Financial Statement of Debtor (Step by Step)

To complete a Form 770 Financial Statement of Debtor, you will need to provide the following information:

- Name

- SBA loan number

- Date of birth

- Address

- Phone number

- Social security number

- Occupation

- Length of current employment

- Employer’s name

- Address

- Phone number

- Monthly income

- Other employers within last 3 years

- Name of spouse

- Social security number

- Date of birth

- Occupation

- How long in present employment

- Spouse’s employer

- Address

- Phone number

- Monthly income of spouse

- Other employers in last 3 years

- Other dependents

- Total monthly income of dependents

- For what period did you last file a federal income tax return

- Where was the tax return filed

- Amount of gross income reported

- Fixed monthly expenses

- Assets and liabilities

- Loans payable

- Real estate being purchased on contract or mortgage

- Life insurance policies

- Real and personal property owned by spouses and dependents valued in excess of $500

- All transfers of property, including cash, made within the last three years exceeding $500

- Whether you are a co-maker, guarantor, or a party in any lawsuit or claim now pending

- Whether you are a trustee, executor, or administrator

- Whether you are a beneficiary under a pending or possible inheritance or trust

- When you believe you can begin making payments on your SBA debt

- How much you believe you can pay SBA on a monthly or periodic basis

- Signature

- Date