What is a 1040A?

A 1040 A form is used by the Internal Revenue Service during tax filing season. It is used to file federal income taxes. It is known as the U.S. Individual Income Tax Return form, and it will change from year to year. People who have an income of less than $100,000 and who are using a standard deduction can use this form. Those who are using itemized deductions must use a different federal tax form to file income tax.

A 1040 A form is considered to be easy to use, so if you have certain types of complicated miscellaneous income, you will not be able to use this form. Income such as wages, tips, interest, dividend income, capital gains, IRA payments, and unemployment compensation can be included on a 1040A form. Other taxable income must be reported on a regular 1040 form.

1040a vs 1040

A Form 1040A is different from a Form 1040 because the income and adjusted gross income sections on a Form 1040A are much shorter. A Form 1040 allows your to itemize deductions, but a Form 1040A does not.

A Form 1040EZ is even shorter than a Form 1040A.

Do I qualify to file for a 1040A form?

To qualify to use Form 1040A, you need to make a taxable income of less than $100,000 and not want to claim an alternative minimum tax (AMT) adjustment on stock gain from exercising a stock option incentive. You also cannot itemize your deductions and must claim the standard deduction instead.

Most Common Uses

The 1040A is commonly used because it is must faster and easier to prepare by hand than the 1040, but still allows more deductions and tax credits than a 1040EZ Form. For example, the 1040EZ does not allow you to deduct IRA contributions or student loan interest, but the 1040A does.

The 1040A is also used to help the parents of college-aged student to qualify for FAFSA via its simplified need test. If you are eligible to file Form 1040A, a student may be eligible for additional financial aid. The simplified needs test requires that parents have an adjusted gross income (AGI) of less than $50,000 and every family member be eligible to file a Form 1040A, 1040EZ, or not required to file a tax return.

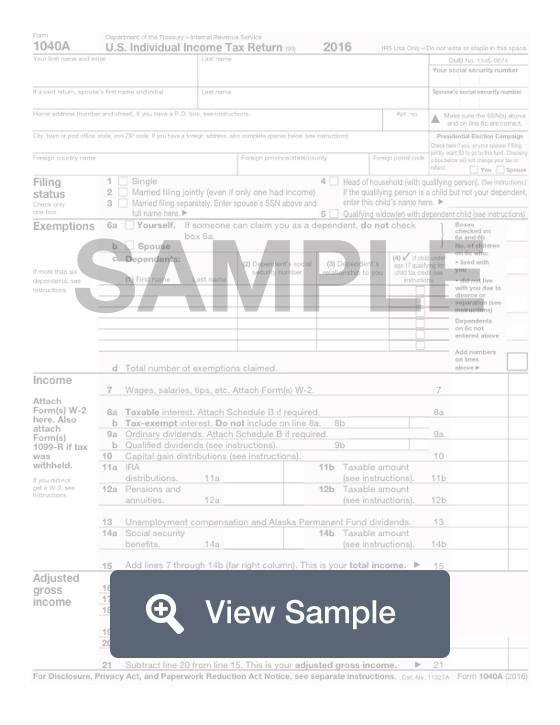

Components of a 1040A

A Form 1040A includes the following sections:

- Filing Status and Dependents - Choose your filing status (single, married filing jointly, married filing separately) and list your dependents

- Types of Income - The 1040A allows income from wages, interest and dividends, capital gain distributions, taxable grants and scholarships, pensions, annuities, IRA distributions, unemployment compensation, Social Security and railroad retirement benefits, and Alaska Permanent Fund dividends

- Allowable Deductions - You can include deductions for classroom expenses, IRA contributions, student loan interest, college tuition and fees

- Available Tax Credits - You can include the Child Tax Credit, Additional Child Tax Credit, American Opportunity Credit, Lifetime Learning Credit, Earned Income Tax Credit, Credit for Child and Dependent Care Expenses, Credit for the Elderly and Disabled, and tax credit for retirement savings contributions

How to Complete a 1040a (Step by Step)

To fill out a IRS Form 1040A, you will need to provide:

- Name - first name, middle initial, last name

- Social security number

- Spouse’s name and SSN

- Home address

- Any foreign country/state/province/postal code

- Filing status - single, married filing jointly, married filing separately, head of household, qualifying widow or widower

- Exemptions - note if no one can claim you as a dependent, list all dependents

- Income - wages, salaries, tips, taxable interest, tax-exempt interest, ordinary dividends, qualified dividends, capital gain distributions, IRA distributions, pensions and annuities, unemployment compensations and Alaska Permanent Fund dividends, social security benefits, total income

- Adjusted gross income - deductions for educator expenses, IRA, student loan interest, tuition and fees

- Tax, credits, and payments - standard deduction, exemptions, taxable income, total credits, total tax, earned income credit, total payments

- Refund - if your total tax payments exceed your total tax amount, you need to provide routing information for your bank account for a direct deposit or instruct the IRS to apply it to your current year’s estimated taxes

- Amount you owe - if your total tax amount exceeds your total payments, any tax penalty

- Third party designee - any person who has your authorization to discuss your tax return with the IRS

- Signature - signature and date of you and your spouse

- Tax preparation information - If you paid to have someone else fill out your return, they must provide their name, contact information, EIN, and signature

External Resources

About the 1040A: https://www.irs.gov/forms-pubs/about-form-1040-a

Instructions: https://www.irs.gov/pub/irs-pdf/i1040a.pdf

Form 1040A: https://www.irs.gov/pub/irs-pdf/f1040a.pdf

Form 8917 - Tuition and Fees Deduction: https://www.irs.gov/pub/irs-pdf/f8917.pdf

Form 2441 Child and Dependent Care Expenses: https://www.irs.gov/pub/irs-pdf/f2441.pdf

Schedule R Credit for Elderly or Disabled: https://www.irs.gov/forms-pubs/about-schedule-r-form-1040-a-or-1040

Form 8863 American Opportunity and Lifetime Learning Tax Credits: https://www.irs.gov/pub/irs-pdf/i8863.pdf

Form 8880 Credit for Qualified Retirement Savings Contributions: https://www.irs.gov/pub/irs-pdf/f8880.pdf

Schedule 8812 Child Tax Credit and Additional Child Tax Credit: https://www.irs.gov/pub/irs-pdf/f1040s8.pdf

Schedule EIC Earned Income Credit: https://www.irs.gov/pub/irs-pdf/f1040sei.pdf

Form 8888 Allocation of Refund: https://www.irs.gov/pub/irs-pdf/f8888.pdf