What is an EZ 1040?

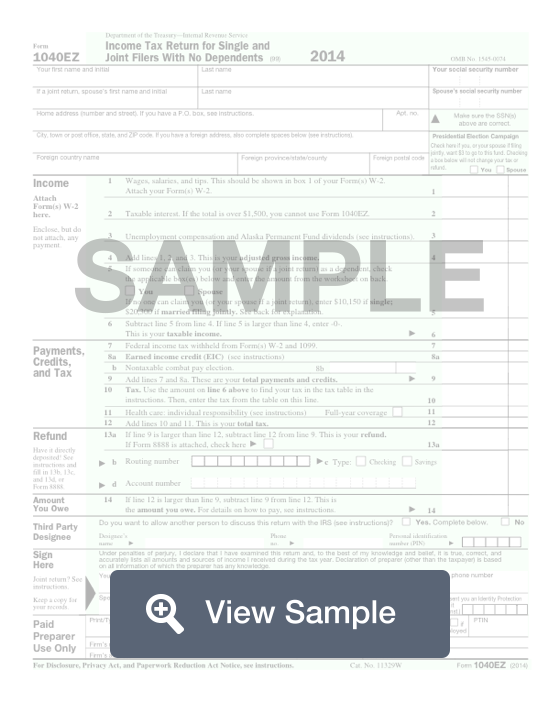

A 1040-EZ tax form is used for tax filing. It is the simplest form available to use for filing your federal taxes. Only certain people are eligible to use this tax filing form. The form is only one page long and has four different sections that must be filled out before the form is completed.

Only people who have made less than $100,000 in the tax year, do not have any dependents, and are filing single or married filing jointly can use form 1040-EZ for filing their federal taxes. The form will ask you for the information about your taxable income, including salary, tips, and other compensation. It will also make sure you are not claiming any dependents. If you are unsure about whether or not you can use this form, ask a tax professional and give them as much information as possible about your taxes.

1040EZ vs 1040

The 1040 Form is 80% longer than the 1040EZ Form. IRS Form 1040 contains space to claim dependents, while the 1040EZ does not.

The 1040EZ only allows a person to record wages, salaries, tips, taxable interest under $1,500, and unemployment compensation payments. The 1040 Form contains more types of income such as dividend payments, retirement account distributions, farm and rental income, Social Security benefits, and alimony.

Form 1040EZ only allows a few tax credits or deductions. Form 1040 allows many more deductions, including educational costs and health care savings plan contributions.

There is also a Form 1040A, which is a hybrid between a Form 1040 and 1040-EZ.

Most Common Uses

The Form 1040EZ is typically used by taxpayers who have one source of income, few deductions, and no dependents. If you have children, purchase real estate, inherit a significant amount of money, or make a large sum of money through investment, you will typically not use this form.

If you received a scholarship or fellowship grant or tax-exempt interest income, you are cautioned to read the instructions prior to filling out the form.

Components of an EZ form

- Personal information - including name, address, and social security number

- Sources of income - list wages, salaries, tips, taxable interest of $1,500 or less

- Payments, credits, and tax - list payments that have already been made by you or your employer on your behalf

- Calculating refunds and amounts due - if your total tax payments and credits exceed the amount due, you are entitled to a refund. If you underpaid, you are required to make a payment for the remaining balance.

- Signature - tax returns are not valid without signatures

How to complete an EZ form (Step by Step)

You will need to provide

- First name, middle initial, last name

- Spouse’s name

- Home address (number, street, city, state, ZIP code, foreign country, foreign province)

- Wages, salaries, tips (attach W-2)

- Taxable interest

- Unemployment compensation and Alaska Permanent Fund dividends

- Adjusted gross income

- Whether anyone can claim you or your spouse as a dependent, standard deduction depending on filing status

- Federal income tax withheld

- Earned income credit (EIC)

- Nontaxable combat pay election

- Total payments and credits

- Tax

- Health care

- Total tax

- Tax refund

- Banking information

- Amount owed

- Designee who is allowed to discuss return with IRS

- Signature

- Tax preparer’s name, signature, contact information