What is a 1099 K?

A 1099-K form is used during the tax season. It is a fairly new form that the IRS created in 2013. The form will be sent to people who have received over $600 in income from online debit or payment card transactions during a calendar year. This is used for people who make money online using stores through sites like Etsy, Amazon or Paypal.

The 1099-K form is used to help someone verify how much income they really made through an online store or sales. This can ensure that people are reporting their income properly on their tax return. The form can come in handy if you aren't sure how much you made from a certain store, or if you want to double check your income records.

1099k vs 1099 NEC

The 1099-NEC is issued to independent contractors or self-employed people who have been paid $600 or more during a fiscal year. You may not receive a 1099-NEC if you were paid less than $600, but you are still responsible for reporting all income.

The 1099-K is used by credit card companies and third-party payment processors to report payments that they process for third parties. You will receive a 1099-K if you accepted credit cards, debit cards, or prepaid cards and had over $600 in sales through a third party processor during a tax year.

The 1099-K is a newer tax form that came into existence as part of the 2008 Housing Assistance Tax Act.

Most Common Uses

Most retailers who accept online payments from customers will receive a 1099-K once its annual activity has met the following:

- Volume of over $600 in sales through third party processors

Components of a 1099 K

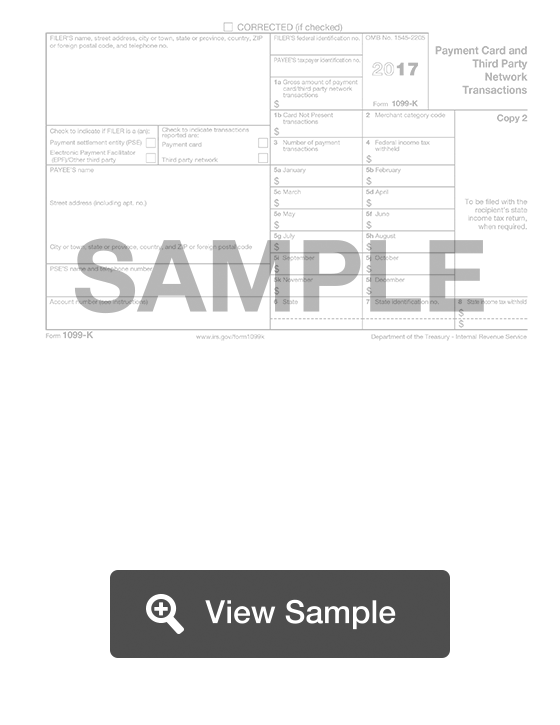

The 1099 K contains information for filer’s name and contact information, filer’s status, reported transactions classification, payee’s name and contact information, PSE’s name and phone number, account number, and information regarding reportable transactions.

How to complete a 1099 K (Step by Step)

To complete your 1099 K, you should fill out:

- Filer’s name, address, telephone number

- Indicate if Filer is a Payment Settlement Entity (PSE) or Electronic Payment Facilitator (EPF) or other third party

- Indicate if the transactions reported are from a Payment Card or Third Party Network

- Payee’s name

- Payee’s address

- PSE’s name and telephone number

- Account number

- Filer’s TIN

- Payee’s TIN

- Gross amount of payment card/third party network transactions

- Card not present transactions

- Merchant category code

- Number of payment transactions

- Federal income tax withheld

- Gross amount of payment care transactions broken down by month

- State

- State identification number

- State income tax withheld

Legal Considerations

What should I do with this information?

The information that you receive on your 1099-K can be used to update your books and records to reflect your accurate business income. You must report on your income tax return all of the money that your receive from your business. Your 1099-K amounts plus any cash, checks, or other form of payments combined will be used to calculate your gross receipts for your income tax return.

Statement Breakdown

When you receive your Form 1099-K, you should ensure:

- That the form belongs to you and is not a duplicate - if the form does not belong to you, contact the Payment Settlement Entity listed on the form to determine why you received the document

- The payee TIN is correct

- The gross amount of transactions is correct

- The number of payment transactions is correct

- The Merchant Category Code (MCC) accurately describes your business

If there is an error on your form, you should request a corrected 1099-K from the PSE.

My total gross payment shown on the form doesn’t belong to me

Sometimes, the total gross payment amount that is on your Form 1099-K does not belong to you. This might happen if:

- You report your business income of a Form 1120, 1120S, or 1065 and receive a Form 1099-K in your name.

- If you shared your credit card terminal with another business

- If you bought or sold your business within the year

- If you changed your business entity structure during the year

- If your business has multiple forms of income

If you have any questions about the amount reported, contact the Filer. If you have any questions about the merchant or third party transaction network, find their contact information on the lower left corner of Form 1099-K.

Reporting a 1099K on a tax return

If you are self-employed, you should report your 1099-K payments on Schedule C on separate revenue line. If you are filing a Schedule F for farming, you will report 1099-K payments there.