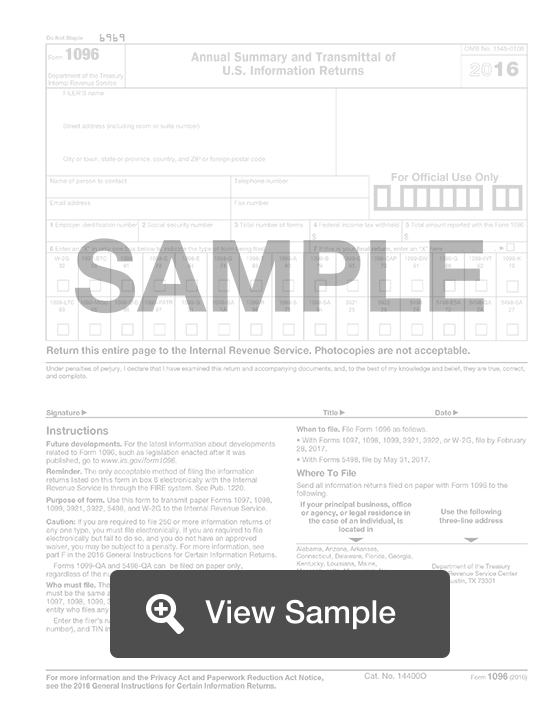

Form 1096

IRS Form 1096 is a tax form used by tax-tempt organizations when they prepare their federal filings. It is better known as an Annual Summary and Transmittal of US Information Returns. Although organizations with tax-exempt status are not required to pay certain federal and state taxes, they are still obligated to provide certain information to the IRS.

Table of Contents

What is a Form 1096?

This form will be used by the United States Internal Revenue Service for tax filing purposes. A Form 1096 is also known as an Annual Summary and Transmittal of U.S. Information Returns. Tax-exempt organizations will use this form to transmit various forms to the IRS. These forms could be a 1099, 1098, 5498, or a W-2G.

This form will require the personal information for the filer. This includes name, address, contact information, and a tax identification number such as a social security number. The amount of Federal tax withheld will need to be listed, as well as the total amount of money being reported on the form. The forms that are being transmitted should be checked off, and the total number of forms should be included. This will ensure that the IRS knows which forms to expect, so tax filing can be a smoother process.

Most Common Uses

Form 1096 is only used when filing physical forms. If you are filing forms electronically, Form 1096 is not required.

Any person or entity who files by paper forms W-2G, 1098, 1098-E, 1098-T, 1099-A, 1099-C, 1099-CAP, 1099-DIV, 1099-G, 1099-H, 1099-INT, 1099-LTC, 1099-MISC, 1099-OID, 1099-PATR, 1099-Q, 1099-R, 1099-S, 1099-SA, 3921, 3922, 5498, 5498-ESA, and/or 5498-SA, must prepare and submit Form 1096 as well

Components of a Form 1096

Form 1096 contains sections for:

- Filer’s information

- Forms that are being filed

How to complete a Form 1096 (Step by Step)

You need to submit a separate 1096 for every type of information return than you have given to a recipient.

To complete a Form 1096, you will need to provide the following information:

- Filer’s name

- Street address

- Name of contact person

- Phone number

- Email address

- Fax number

- Employer identification number

- Social security number

- Total number of forms

- Federal income tax withheld

- Total amount reported on this form

- Type of form being filed

- W-2G

- 1097-BTC

- 1098

- 1098-C

- 1098-E

- 1098-F

- 1098-Q

- 1098-T

- 1099-A

- 1099-B

- 1099-C

- 1099-CAP

- 1099-DIV

- 1099-G

- 1099-INT

- 1099-K

- 1099-LS

- 1099-LTC

- 1099-MISC

- 1099-OID

- 1099-PATR

- 1099-Q

- 1099-QA

- 1099-R

- 1099-S

- 1099-SA

- 1099-SB

- 3921

- 3922

- 5498

- 5498-ESA

- 5498-QA

- 5498-SA

- Form 1099-MISC with NEC

- Signature

- Title Date

Filing

If you need 1096 Forms, you can get them:

- At an office supply store

- From an account, bookkeeper, or payroll service

- From the IRS

Form 1096 is due by January 31. You do not need to file Form 1096 if you e-file your 1099 forms.

You must submit the red scannable from to the IRS. You are subject to a $50 fine if you submit a form that is not scannable.