What is a 1099-G?

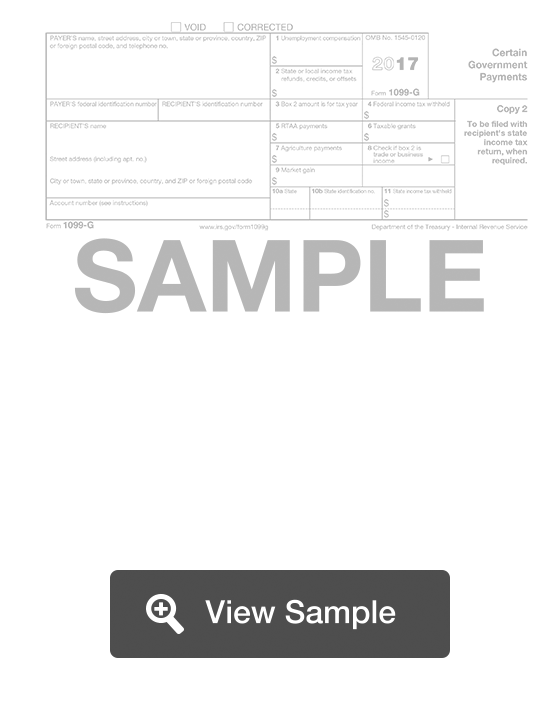

A Form 1099-G is also known as a Certain Government Payments form. It will be used for tax filing purposes, and is issued by the Internal Revenue Service. This form will be filed by various government agencies if they have made certain payments during the tax year. This includes local, state, and federal governments. Payments that may need to be listed include unemployment compensation, tax refunds or credits, grants, and agricultural payments.

There will be various boxes for the different government payments made. Any taxes already withheld should be listed. This will ensure that the financial information included on a tax return form will be accurate. In addition to the financial information, personal information about the payer must be included. This will enable the IRS to identify the taxpaying party. This information may include a special account number, which will identify the government agency.

Most Common Uses

Form 1099-G is a statement that is commonly used to notify taxpayers and the IRS of unemployment compensation and state or local income tax refunds received during the year.

Components of a 1099-G

A Form 1099-G contains the following sections:

- Payer information

- Recipient information

- Unemployment compensation

- State or local income tax refunds, credits, offsets

- Federal and state income tax withheld

- Other payments, grants, gains

- Account number

How to complete a 1099-G (Step by Step)

To complete a 1099-G, you need to provide the following information:

- Payer’s name, address, phone number

- Payer’s TIN

- Recipient’s TIN

- Street address

- Account number

- 2nd TIN

- Unemployment compensation

- State or local income tax refunds, credits, offsets

- Tax year

- Federal income tax withheld

- Reemployment trade adjustment assistance (RTAA) payments

- Taxable grants

- Agriculture payments

- Trade or business income

- Market gain

- State

- State identification number

- State income tax withheld

Commonly Asked Questions

Why did you receive a Form 1099-G?

The most common reason to receive a Form 1099-G is because you have received unemployment income from the government or a refund, credit, or offset or state or local income. You may also receive a Form 1099-G for reemployment trade adjustment assistance payments; taxable grants from federal, state, and local governments; taxable payments from the Department of Agriculture; and market gains on Commodity Credit Corporation loans.