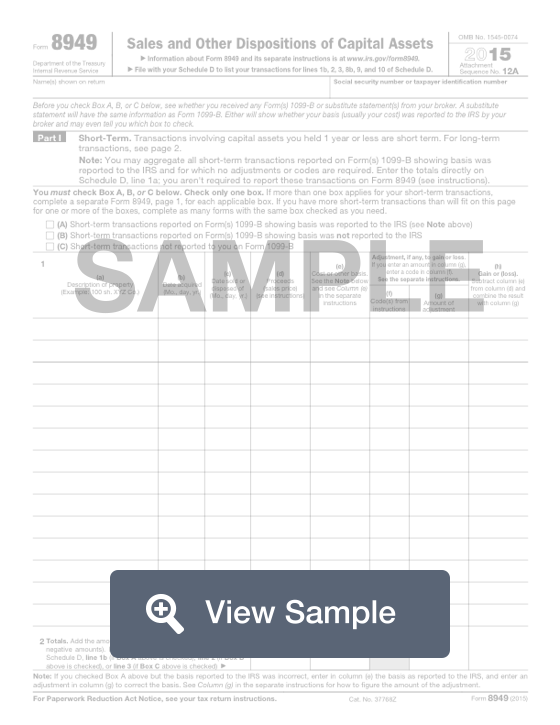

What is a Form 8949?

This form is used by the U.S. Internal Revenue Service for tax filing and reporting purposes. The Form 8949 is also known as a Sales and Other Dispositions of Capital Assets form. It will be used to report capital gains and losses from transactions that involved certain transactions, such as those involving investment properties.

Both short-term and long-term capital gains will be included on the Form 8949. This form should be completed before you file a Schedule D with the IRS. It will allow you to calculate the information you will need for your full tax return. This will help you determine your owed or refunded tax amounts.

If you have several transactions, you will need to fill out multiple forms. Make sure each form is filled out completely. You will need to make sure each transaction is selected correctly, otherwise there may be delays in your tax processing.

Most Common Uses

Form 8949 is commonly used to report transactions such as distributed capital gain, undistributed capital gains, sale of a main home, sale of capital assets held for personal use, sale of a partnership interest, capital losses, non-deductible losses, losses from wash sales, short sales, gains or losses from options trading, and disposition of inherited assets.

This form is also used to report gains from involuntary conversions of capital assets not held for business or profit, non-business bad debts, and undistributed long-term capital gains from Form 2439. Some partnerships and corporations may also use Form 8949 to report gains and losses from a partnership, an S corporation, an estate or trust.

Components of a Form 8949

A Form 8949 contains sections for:

- Personal information

- Part I - Short Term

- Part II - Long Term

How to complete a Form 8949 (Step by Step)

To complete a Form 8949, you need to provide the following information:

- Personal information

- Name shown on your tax return

- Social security number or taxpayer identification number

- Part I - Short Term

- Indication of which circumstances apply to your short-term transactions

- Short-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS

- Short-term transactions reported on Form(s) 1099-B showing basis wasn’t reported to the IRS

- Short-term transactions not reported to you on Form 1099-B

- For each transaction:

- Description of property

- Date acquired

- Date sold or disposed of

- Proceeds

- Cost or other basis

- Adjustment to the gain or loss (code and amount)

- Gain or loss

- Totals

- Indication of which circumstances apply to your short-term transactions

- Part II - Long Term

- Indication of which circumstances apply to your long-term transactions

- Long-term transactions reported on Form(s) 1099-B showing basis was reported to the IRS

- Long-term transactions reported on Form(s) 1099-B showing basis wasn’t reported to the IRS

- Long-term transactions not reported to you on Form 1099-B

- For each transaction:

- Description of property

- Date acquired

- Date sold or disposed of

- Proceeds

- Cost or other basis

- Adjustment to the gain or loss (code and amount)

- Gain or loss

- Totals

- Indication of which circumstances apply to your long-term transactions

In general, long-term transactions are capital assets that you held one year or less and long-term transactions are capital assets that are held for more than one year.