What is an RMA form template?

An RMA form (Request for Mortgage Assistance form) is used by individuals who are struggling to make their mortgage payments and would like to submit a request to their mortgage provider for assistance. This form is provided by the federal government and will be given to the individual's particular mortgage servicer.

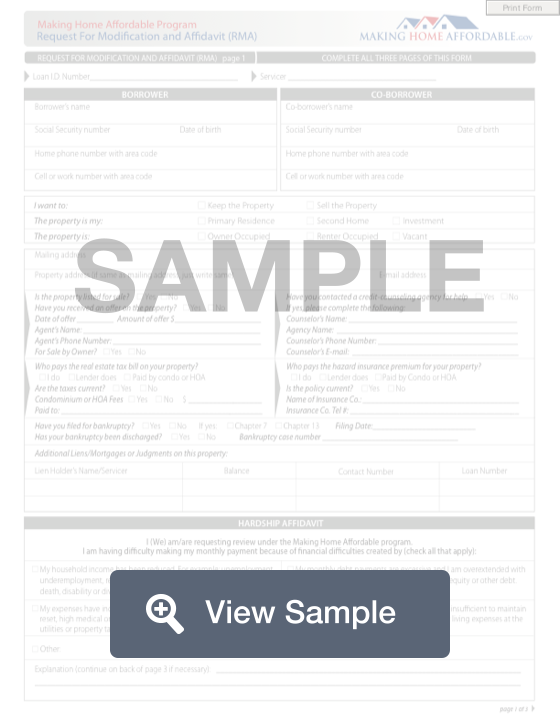

This form requires detailed information about the borrower's current financial situation. The information provided will allow the mortgage lender to determine the filer's eligibility for mortgage assistance. The filer will need to list their current income, debts, expenses, employment, bankruptcies, and other issues that may be affecting them. The filer will also need to include specific information about their home and mortgage so that the lender can determine exactly what kind of assistance the borrower may be eligible for.

Request Form (Short Definition)

If a mortgagor is experiencing financial hardship and needs help, they must complete a Request for Mortgage Assistance form (RMA form) that includes the required documentation to be considered for foreclosure prevention options.

They must provide personal information and their intentions to either keep or transition out of their property, a description of the hardship that prevents them from paying their mortgage(s), information about all of their income, expenses and financial assets, whether they have declared bankruptcy, and information about the mortgage(s) on their principal residence and other single family real estate that they own. (Source: https://homeloanhelp.bankofamerica.com/assets/documents/Other_RMA_Bank-of-America.pdf)

Common Uses

The Request for Mortgage Assistance form is used to permanently change one or more terms of a mortgage loan. It can be used to lower the rate, extend the length of the term, or reduce the principal to bring down the amount of a monthly payment. In the USA, modifications are made under the government’s Home Affordable Modification Program (HAMP), which is sometimes called the “Obama program.”

You may be eligible for a loan modification under HAMP if:

-

You are having trouble making your mortgage payments because of financial hardship

-

You obtained your mortgage on or before January 1, 2009

-

Your property has not been condemned

-

You owe up to $728,750 on your primary residence or one to four unit rental property

Even if your bank is not participating in HAMP, they may have another in-house modification program.

RMA Form Template

Please see the following links for RMA form templates:

How to Complete an RMA Form Template

An RMA form requires you to fill out multiple pages of information. The information that you must provide includes:

-

Loan I.D. Number

-

Loan provider

-

Borrower’s name

-

Social Security number

-

Date of birth

-

Home and cell phone numbers

-

Co-borrower’s information

-

Plans for property - keep or sell

-

Property information - primary residence, secondary residence, or investment property

-

Property’s occupants - owner, renter

-

Mailing address

-

Property address

-

Sale information - whether property is listed for sale, whether offer has been made

-

Credit counseling information - Whether you’ve contacted an agency for help, contact name

-

Property tax information

-

Hazard insurance information

-

Bankruptcy information

-

Additional mortgage/lien/judgments on property

-

Hardship affidavit

-

Income and expense information

-

Signature

In other industries, RMA stands for Return Merchandise Authorization and Return Material Authorization. In these industries, RMA forms require details such as RMA number, order number, company name, part number, customer information, product information, warranty period, repair cost, and return instructions.

Return Merchandise Authorization (Short Definition)

A return merchandise authorization is also known as an RMA form. It is a part of the process of returning a product to receive a refund, replacement, or repair during the product's warranty period. Both parties can decide how to handle the situation, which could be a refund, replacement or repair.

This page is not for information about a Return Merchandise Authorization form. Please instead see the following link:

https://en.wikipedia.org/wiki/Return_merchandise_authorization